TOP 10 MOBILE BANKING APPS IN NIGERIA

It has been established overtime that Nigeria has one of the best banking systems in the World and that is unbelievably true considering how shattered and dehumanizing the whole system can be for true Nigerians who see beyond the international accolades given to our banking systems.

But Inspite of how difficult our banks can be and how unbelievable they could fail when needed the most, Some Nigerian banks have been able to develop mobile banking applications to lessen the normal banking stress in the country.

Here are the top 10 banks with the best mobile banking applications in the country:

10. The Sterling One bank:

This very bank application has one of the best UI’s in the banking space and from experience, it is quite swift and stable.

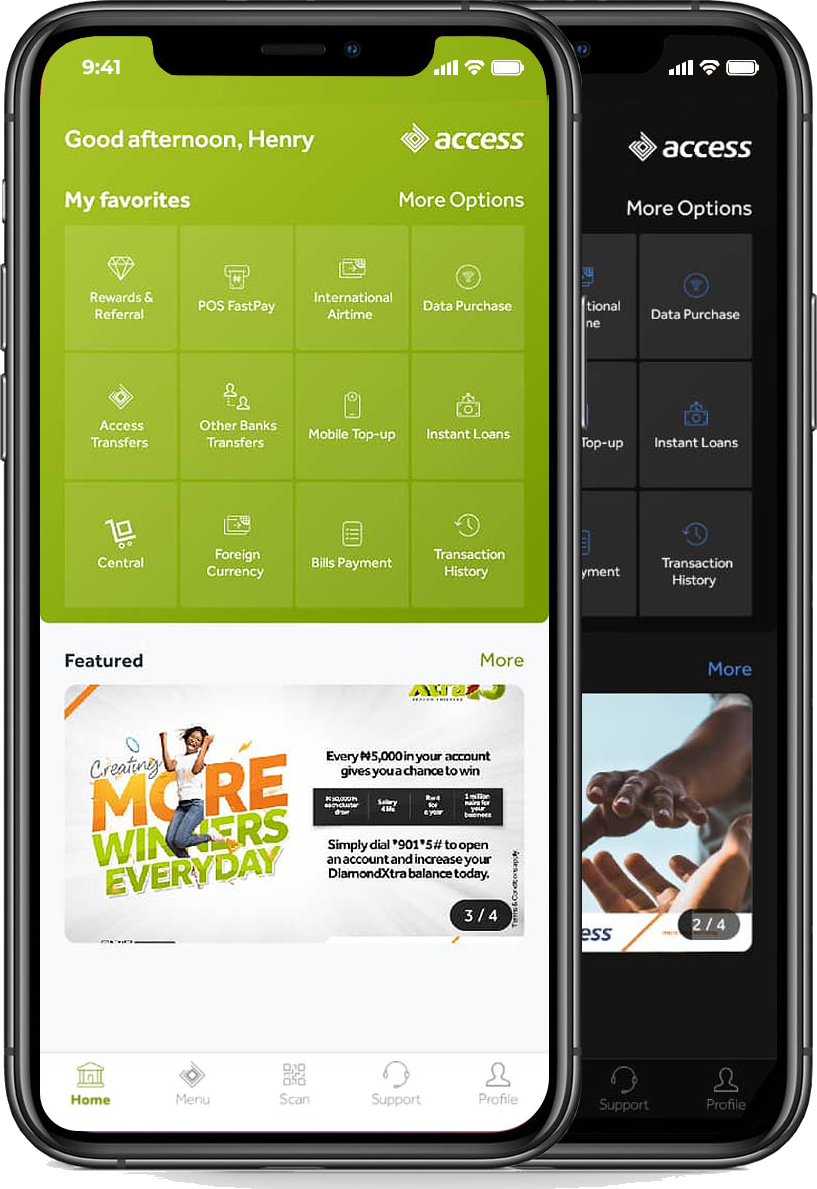

9. Access Bank:

this mobile banking app gives a real time access to your bank accounts in Access Bank. It comes with so many features such as Bill payments, request for cheque books and locating access Bank branches and ATM galleries across the nation.

8. GTWorld by Guaranty Trust Bank:

this special banking app belongs to the ever famous Gen Z bank GTBank which caters to hundreds of millions of customers across the nation. It comes with a special facial recognition feature, checking of balance, request and sending of bank statements to an embassy of choice and many more features.

7. UBA Mobile Banking App:

this Bank app comes with amazing features like the ability to toggle between the day and night modes, an indemnity profile to set up daily transaction limits, biometric login option, an auto reminder for recurrent Bill payments and transfers.

6.V by VFD Microfinance:

this banking platform was launched less than 3 years ago and as gone one to become one of the most recognized in the country because of brilliantly they have performed over time as they cater to over a million virtual customers. Vbank offers so many features including saving Beneficiaries, having multiple accounts within the app, hiding your balance option but most of all, it is quite swift and reliable.

this banking platform was launched less than 3 years ago and as gone one to become one of the most recognized in the country because of brilliantly they have performed over time as they cater to over a million virtual customers. Vbank offers so many features including saving Beneficiaries, having multiple accounts within the app, hiding your balance option but most of all, it is quite swift and reliable.

5. Opay:

this mobile banking platform caters to over 15 million users Nationwide and they have so far been amazing. They offer free debit card provision, Free transfers across all banks, instant account opening with a welcome bonus and an unbelievable 24/7 customer support but most importantly, this bank app is unbelievably swift in response as transactions are completed successfully in less than a minute.

this mobile banking platform caters to over 15 million users Nationwide and they have so far been amazing. They offer free debit card provision, Free transfers across all banks, instant account opening with a welcome bonus and an unbelievable 24/7 customer support but most importantly, this bank app is unbelievably swift in response as transactions are completed successfully in less than a minute.

4. FCMB NEW MOBILE:

FCMB New mobile caters for a demograph that loves ease. You could open an account, pay for tickets and order meals, QR codes and cardless payments and withdrawals and a personalized profile.

FCMB New mobile caters for a demograph that loves ease. You could open an account, pay for tickets and order meals, QR codes and cardless payments and withdrawals and a personalized profile.

3.ALAT by Wema Bank:

Alat rose to prominence after Popular Nigerian singer Davido used them for a crowdfunding on his birthday. ALAT has gone ahead to win numerous Awards, and they offer some amazing services like the group savings target and rotating savings. International payments, granting personal loans, savings with discount and a 4% annual increase on savings account.

Alat rose to prominence after Popular Nigerian singer Davido used them for a crowdfunding on his birthday. ALAT has gone ahead to win numerous Awards, and they offer some amazing services like the group savings target and rotating savings. International payments, granting personal loans, savings with discount and a 4% annual increase on savings account.

2. FirstMobile by First Bank Nigeria:

the premier bank offers a bank app that has one of the simplest users interface and experience. This is one of the few bank interfaces with the older generation in mind. A solid 8/10 for me.

the premier bank offers a bank app that has one of the simplest users interface and experience. This is one of the few bank interfaces with the older generation in mind. A solid 8/10 for me.

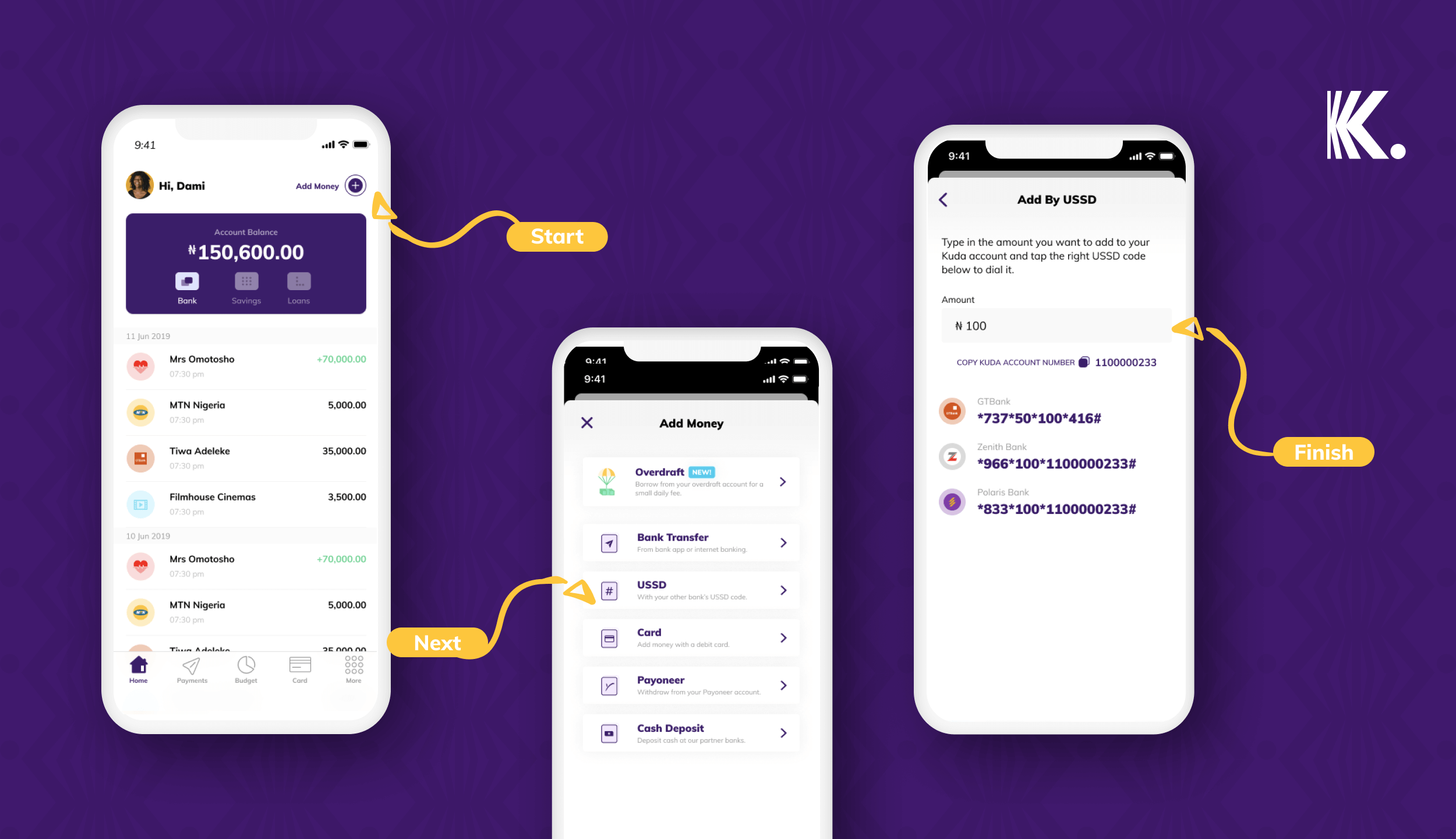

1. KUDA by Kuda microfinance Bank :

this is my own bank so pardon my bias, but in all honesty, KUDA has been an amazing bank so far.

this is my own bank so pardon my bias, but in all honesty, KUDA has been an amazing bank so far.

They offer so many mind blowing services amongst them are is

the easy transfer of funds which is in most cases free, Save as

you spend feature which allows you to save a percentage of what

you’ve budgeted to spend over a period of time, investments

opportunities, provision of a debit card and the ease of carrying

out daily transactions without fear of network failure with an

amazing customer service. Another thing about the kuda app is

the beautiful user interface. You’ll literally have a bright smile the

moment you see the brightly colored purple Surrounding the kuda symbol.